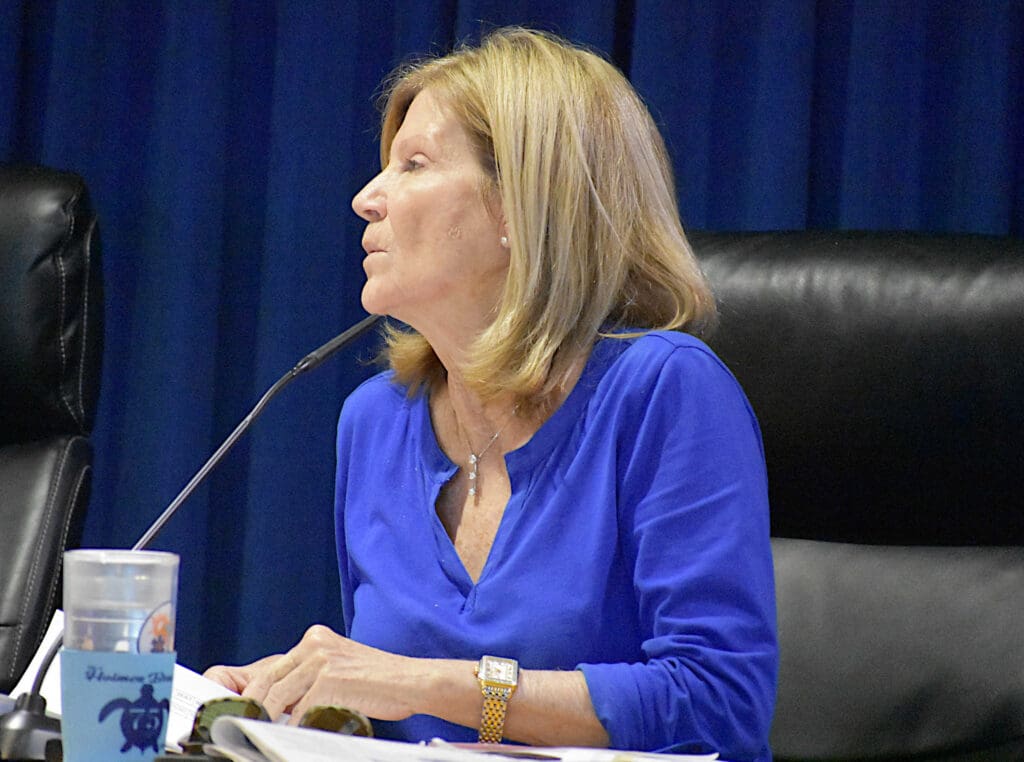

HOLMES BEACH – Mayor Judy Titsworth and city staff presented a proposed $23.7 million 2025-26 fiscal year city budget that’s currently based on increasing the current millage rate from 1.99 mills to 2.1812 mills.

At 2.1812 mills, Holmes Beach property owners would pay an ad valorem city property tax rate of $2.18 per every thousand dollars of assessed taxable property value.

City commissioners are expected to formally adopt this year’s maximum millage rate during their Monday, July 22 meeting that starts at 2 p.m. The adopted maximum millage rate can then be lowered, but not increased, before two budget adoption hearings are held in September. The 2025-26 fiscal year begins on Oct. 1.

When presenting the proposed budget during the city commission’s July 8 budget work session, City Treasurer Julie Marcotte said the millage rate increase is proposed to offset the 8.33% decline in Holmes Beach property values, as established by the Manatee County Property Appraiser’s Office.

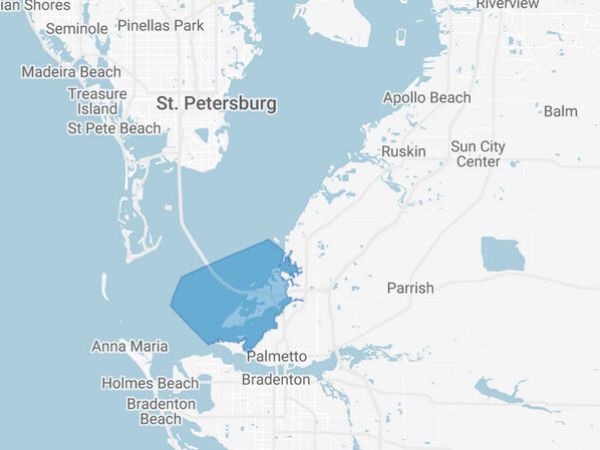

According to the property appraiser’s 2025 Taxing Authority Report, the 4,759 parcels in Holmes Beach have a total taxable value of $3.26 billion. Development Services Director Chad Minor said 1,671 of those parcels are being used as vacation rentals. According to the 2024 report, 4,762 parcels in Holmes Beach had a total taxable value of $3.54 billion.

Marcotte said the lower property values would produce a $590,000 decrease in the city’s ad valorem property tax revenues if the 1.99 millage rate is maintained. The proposed millage rate increase would result in the city receiving about the same amount of city property tax revenues as it did this year at the 1.99 rate.

An increased millage rate combined with lower appraised property values would result in most property owners paying about the same amount of city property taxes in the coming fiscal year. Property owners are also subjected to the taxes and fees levied by the county, school board, fire district and other taxing authorities that account for a significant portion of a property owner’s total annual tax bill.

BUDGET SPECIFICS

State law requires cities to operate with balanced budgets where projected revenues match the projected expenditures. The $23.7 million in projected 2025-26 revenues includes $7.46 million in reserve funds to be carried over from the current 2024-25 fiscal year budget, which is $25.2 million.

The proposed budget for the general operations of the city that includes employee salaries and benefits is $1.77 million – a decrease from the $1.94 million budgeted this year.

The current fiscal year police department budget is $5.49 million. Marcotte and Police Chief Bill Tokajer propose increasing it to $5.52 million for the coming fiscal year. The proposed increase includes Tokajer’s yet-to-be-approved request to hire an additional officer with a starting pay range between $68,000-$72,000.

The building department budget Marcotte and Minor proposed would increase from $1.37 million to $1.6 million, but increased building permit revenues and other development fees are expected to cover the additional expenses incurred by the one department that generates as much or more money than it spends.

The public works department budget proposed by Marcotte and Public Works Director Sage Kamiya anticipates expenditures decreasing from $4.08 million to $3.58 million in the coming fiscal year. Kamiya said his department is currently three employees short of being fully staffed and he’d like to hire at least one additional employee if approved by the city commission.

Commissioner Terry Schaefer said the proposed public works budget is about $500,000 lower than the current fiscal year and to him that justifies hiring an additional employee and adding about $63,000 to the city payroll.

The proposed budget doesn’t yet factor in a proposed stormwater fee increase from $2.95 per 100 square feet of property to $4.95 or $9 per 100 square feet. The proposed budget lists $1.88 million for anticipated stormwater drainage project expenses and Kamiya said that projection would change if additional revenues are to be generated by a stormwater fee increase.

The projected $765,236 for code compliance department expenditures is about $10,000 higher than the current fiscal year.

Commissioner Carol Whitmore opposes increasing the millage rate at a time when many property owners are still recovering from hurricane damage sustained in 2024. She opposes adding an additional police officer and an additional public works department employee to the city payroll and she opposes the proposed stormwater assessment fee increase to be determined during the commission’s Tuesday, July 22 meeting.