HOLMES BEACH – City officials are already paying attention to the possible elimination of property taxes proposed but not yet defined by Gov. Ron DeSantis and state legislators.

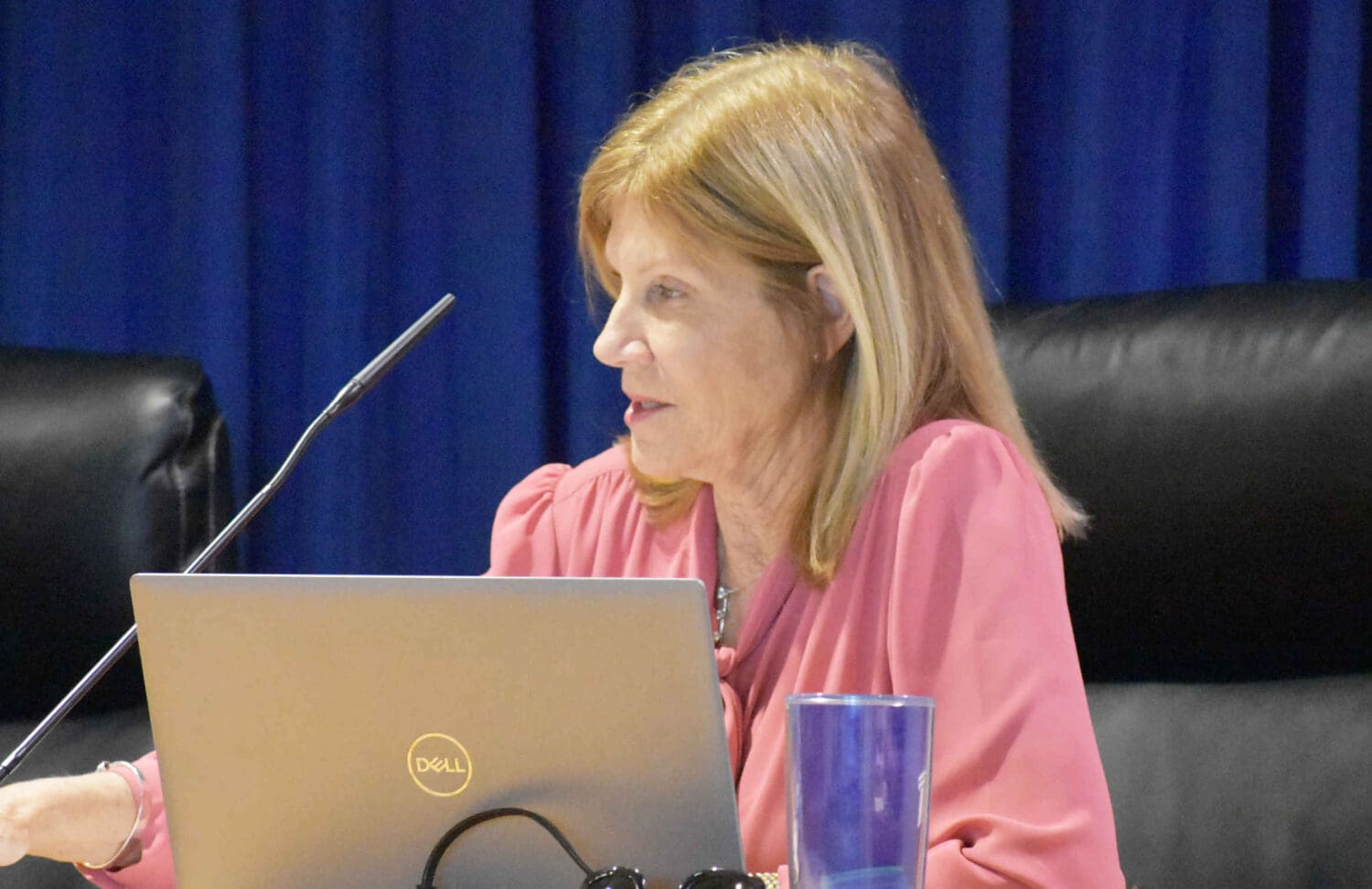

Holmes Beach City Commissioner Carol Whitmore initiated a brief property tax discussion during the commission’s March 25 meeting. After noting that DeSantis recently mentioned eliminating property taxes, Whitmore pointed out that property taxes are the primary funding source for city and county governments, whereas sales taxes and other taxes fund the state government.

Commissioner Terry Schaefer said the Florida League of Cities held a March 24 call-in session that addressed several proposed pieces of legislation that the League is monitoring as the 60-day 2025 legislative session in Tallahassee reached its halfway point.

Regarding the elimination of property taxes, Schafer said, “No one at the meeting felt there was a reasonable alternative to this. We all know property taxes are local and here you have the governor stepping in to eliminate property taxes without any vision, without any determination, as to what would replace that revenue.”

Mayor Judy Titsworth said, “When you take funding away from local governments and county governments what does that do? Well, you cease to exist and then the state is in charge of everything. If this does go to a referendum, I hope people are paying attention.”

“We will fight it,” Whitmore added.

“There’s seemingly a direction to minimize the number of cities from our current state administration,” Schaefer said.

“It’s a strange world we live in right now,” Titsworth said.

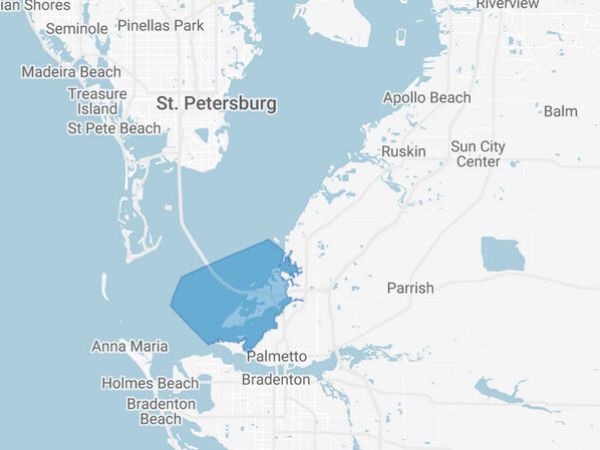

Schaefer said only 12-13% of the total property taxes paid by the owner of a homesteaded primary residence in Holmes Beach are remitted to the city. The rest goes to the county, the school board, the West Manatee Fire Rescue District, the West Coast Inland Navigation District, the Southwest Florida Water Management District, the Mosquito Control District and other taxing districts. Holmes Beach property owners also pay an annual stormwater assessment fee that’s included on their property tax bill.

“We deliver a pretty good return on investment to our taxpayers,” Schaefer said of the city’s ad valorem property tax collections and expenditures.

Using tax bills posted at the Manatee County Property Appraiser’s website, The Sun examined the 2024 property tax bills for six randomly selected residential properties in the R-1 zoning district behind Holmes Beach City Hall. Those property tax bills ranged from $5,925, $7,959 and $9,507 to $15,628, $17,800 and $20,353. The taxes varied according to the property’s assessed taxable value and whether the property was taxed as a homesteaded primary residence or as a non-homesteaded property used as a second home, a vacation home, a rental home of 30 days or more or for some other purpose.

According to the Manatee County Tax Collector’s Office, “The homestead exemption is a constitutional guarantee that reduces the assessed value of residential property up to $25,000 for qualified permanent residents. In 2008, Florida voters approved an additional homestead exemption of up to $25,000 for homeowners whose homes have an assessed value of more than $50,000.”

Elimination study

To date, neither DeSantis nor the state Legislature has provided specific details as to how property taxes would be eliminated or how those lost tax revenues would be recouped. But on Feb. 18, Sen. Jonathan Martin, R-Fort Myers, and Sen. Jason Pizzo, D-Hollywood, co-introduced Senate Bill 852. The bill proposes that the Office of Economic and Demographic Research conduct a study to establish a framework to eliminate property taxes and replace property tax revenues through budget reductions, sales-based consumption taxes and locally determined consumption taxes authorized by the state Legislature. The bill sets forth the proposed study requirements and an Oct. 1 deadline for the study to be presented to the Senate president and the Speaker of the House.

SB 852 states: “The study must include, at a minimum, all of the following: An analysis of the potential impact of eliminating property taxes on public services, including education, infrastructure and emergency services; an assessment of potential housing market fluctuations, including changes in homeownership rates and property values; an evaluation of whether a shift to consumption-based taxes would make Florida more attractive to businesses compared to other states; an analysis of the potential impact of eliminating property taxes on overall economic stability, consumer behavior and long-term economic growth.”

As of March 28, SB 852 had not passed through any of the three Senate committees assigned to discuss the bill and similar legislation had not been introduced in the House of Representatives. The adoption of proposed legislation requires matching bills to be supported respectively by the majority of the Senate and House members.

State Rep. Ryan Chamberlin, R-Ocala, recently filed House Bill 357, which proposes increasing the $25,000 homestead exemption to $100,000. HB/HJR 357 proposes placing the $100,000 homestead exemption on the 2026 general election ballot. If then adopted by Florida voters, the $100,000 exemption would take effect on Jan. 1, 2027.

“Florida’s population has been continuously overburdened by constant increases in property taxes throughout the past several years. The property tax increases are based, unfairly, on unrealized gains for the paper value of our homes,” Chamberlin says in a “Why I filed this bill” statement posted at the House website.

Sen. Blaise Ingoglia, R-Spring Hill, filed SB 1016, a bill that seeks to increase the $25,000 exemption to $75,000.

Foreseeable consequences

The Florida Policy Institute website addresses the foreseeable consequences of eliminating property taxes.

“If policymakers continue to pursue eliminating property taxes outright without a cohesive plan to raise taxes in a progressive manner, some of the consequences are clear:

- Households with low to moderate income, including both property owners and renters, will end up paying more in taxes, as a percentage of their earnings, compared to wealthy residents if sales taxes increase to make up the lost revenue.”

- “Local governments would lose fiscal autonomy as they would no longer collect property taxes, and they would become dependent on the state for funding – whether it is for schools or other public services like police and fire services.”

- “Individuals who currently claim a property tax deduction in their federal income tax returns would lose the deduction; meaning their personal income taxes could potentially increase.”

- “The state government would have to weigh local funding needs alongside statewide services, leading to competition and underfunding if the state’s tax base – presumably sales tax base – shrinks.”