Anna Maria millage rate maintained, stormwater fee increase proposed

ANNA MARIA – The mayor and city commissioners plan to maintain the current 1.65 property tax millage rate for the 2025-26 fiscal year that begins on Oct. 1 and they’re leaning toward increasing the annual stormwater utility assessment fee from $2 per 100 square feet of property to $4.

Anna Maria Mayor Mark Short presented these budget considerations to city commissioners on July 24. Commissioners Kathy Morgan-Johnson, John Lynch (participating by phone), Gary McMullen and Charlie Salem unanimously supported Short’s recommendation to adopt a tentative maximum millage rate of 1.65 mills for the coming fiscal year. Commissioner Chris Arendt was vacationing and didn’t attend the meeting.

The adopted tentative maximum millage rate can be lowered before the final millage rate is adopted during two budget hearings in September, but the 2025-26 fiscal year budget being crafted by the mayor and city staff is based on maintaining the current 1.65 millage rate for another year.

At 1.65 mills, Anna Maria property owners will again pay $1.65 per every thousand dollars of assessed property value – after homestead exemptions and other tax-reducing exemptions are applied. Because the total assessed property values in Anna Maria increased cumulatively by 3%, most Anna Maria property owners will experience a slight property tax increase at the same millage rate.

Stormwater fee

When proposing increasing the stormwater utility fee from $2 to $4 per 100 square feet of property, Short said it would result in the stormwater fee for a 7,500-square-foot residential property increasing from $150 to $300, with the city’s anticipated stormwater utility fee revenues increasing from $328,000 to $656,000. Stormwater fee revenues are used to maintain and improve the city’s drainage and stormwater systems and they also provide matching funds for the stormwater grants that help fund those projects.

Short said Public Works Manager Dean Jones has identified more than $15 million in stormwater and drainage projects and improvements that need to be done.

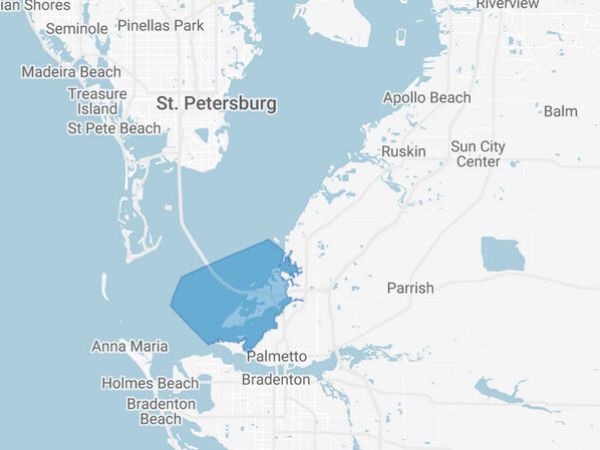

“We have significant stormwater work we need to do, just like every other city on this Island. Some of that needs to be done now, some of that can be done later,” Short said.

A formal vote was not taken on the stormwater fee increase, but commissioners Johnson, Lynch and McMullen voted in favor of directing City Clerk Amber LaRowe to use a third-party firm to distribute letters to all potentially impacted Anna Maria property owners informing them of the proposed increase. Salem opposes increasing the stormwater fee when many residents and property owners are still recovering from the 2024 hurricanes. A formal vote on the proposed increase will occur later in the budgeting process.

Revenues, debt

Short presented a one-page summary of the city’s total projected revenues of $27.2 million for the coming fiscal year – an increase of nearly $10 million from the $17.8 million listed for the 2024-25 fiscal year that ends on Sept. 30.

Maintaining the 1.65 millage rate is expected to generate $3.96 million in ad valorem city property tax revenues in the coming fiscal year, a slight increase from the $3.85 million listed for the current fiscal year.

Short anticipates the city receiving $8.6 million in FEMA reimbursements, but he’s noted on several occasions that those federal funds are not guaranteed and it’s not known when they’ll be received.

Short, a retired accounting executive, noted the projected revenue summary includes $4 million in anticipated debt financing needed to cover the city’s up-front costs while waiting for reimbursement from federal and state agencies. The anticipated reimbursements include FEMA reimbursement for the money the city spent recovering from Hurricanes Helene and Milton, future FEMA assistance to help rebuild the hurricane-damaged City Pier and FEMA reimbursement for some emergency stormwater work the mayor and staff felt was desperately needed. Florida Department of Transportation (FDOT) reimbursement is anticipated to help complete the Pine Avenue sidewalk installation project.

“To accomplish what I hope we will accomplish in this next year, we’re going to need to float some cash to pay for it while we are waiting on reimbursement. The city is in process of setting up $4 million to be available to help us fund the cash flow for these projects while we wait on the reimbursements,” Short said.

The projected revenues include $5.9 million in various grant funds.

After being elected last fall, Short is leading the city’s budget creation process for the first time and Jones and City Treasurer LeAnne Addy thanked him for seeking staff input in the creation of the budget.