Bridge Street project conditionally approved

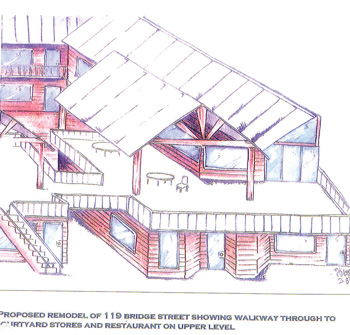

SUBMITTED

A new restaurant and retail complex at 119 Bridge St.

was conditionally approved last week by the city commission.

BRADENTON BEACH – Developer Michael Hynds is one step away from approval of his plan for a 60-seat restaurant and four-store retail project at 119 Bridge Street.

The city commission gave conditional approval to an amended plan he presented Thursday night, addressing the commission’s primary concern over lack of parking by eliminating indoor seating from his restaurant.

“Car parking is not required for open air dining” under the city’s land development code, he said.

Hynds also said that he has an option to lease up to four parking spaces at 114 Third St., a commercially zoned property scheduled to be demolished, to supply parking for the four retail stores he plans, downsized from 10 shops.

Deliveries also will be made via the Third Street property, keeping trucks off Bridge Street, he said.

City Planner Alan Garrett had suggested last month that if Hynds could secure an offsite lot for parking, he could request a special exception to the city’s parking requirements.

Hynds still intends to provide a shuttle bus to take customers between the restaurant and the parking lot at Coquina Beach, which is owned by Manatee County, he said, adding that a county parks department spokesperson could not say whether such a use of a public parking lot is prohibited.

Hynds said he intends to provide a drop off area on Bridge Street to allow the shuttle and other drivers to pull off Bridge Street to drop off and pick up customers, which would not require a walkway to be moved, as a neighboring business owner feared.

The commission also had asked Hynds at a previous meeting to address other concerns.

He told commissioners that stormwater will be retained on the project property and will not affect surrounding properties, that the restaurant’s grease trap will be located under a timber deck at the front of the property, away from a residential area in back where odors could be a problem, and that he would build an indoor, ventilated trash area, also to suppress odors.

Commissioner Gay Breuler commended Hynds on addressing the concerns of commissioners, city staff, planning and zoning board members and the public, then moved for conditional approval of the plan.

City Attorney Ricinda Perry requested that a final vote be taken on Thursday, April 18, at 1 p.m., giving two weeks to write a new application including the new conditions.

Hynds, who developed AMI Plaza in Holmes Beach, had originally proposed up to 10 small retail spaces that would be affordable for start-up businesses, later reducing the number to eight, then four larger shops.