BRADENTON BEACH – The Runaway Bay Condominium Homeowners Association is experiencing a 337% increase in its annual property insurance premiums, an increase that may eventually be felt by other condo associations, resorts, apartment complexes and single-family homeowners on Anna Maria Island and throughout the state.

Frank Witzmann, president of the condo association, said Runaway Bay’s annual property insurance premiums are increasing from $172,152 to $581,259. The increase has resulted in the association’s monthly assessment fee for a one-bedroom condo unit increasing by about $160 per month per unit, with a two-bedroom unit’s fees increasing by about $220 per month per unit, he said.

“We have flood insurance on seven buildings. A different carrier handles that and the flood insurance doesn’t change until June. This was just the property insurance for our buildings, our roofs, wind damage and stuff like that,” Witzmann said.

“In 2021, that policy was carried by American Coastal. There were all kinds of rumblings about insurance going up so when we prepared our 2022 operations budget we budgeted for what we heard might be a worst-case scenario: a 20% increase for property insurance. At the end of July, we got a surprise letter of non-renewal from American Coastal. The letter went to our insurance agent, Mike Angers.

“The letter said they were not renewing our property policy because the roofs were in poor condition. That’s interesting because they’ve never set foot on our roofs. Our roofs were replaced in 2008 and we recently spent $20,000 on maintenance and repairs. The roofing company said our roofs are in good condition. This was an arbitrary decision based on market forces. They put the screws to us and said we’re not going to insure you anymore,” Witzmann explained.

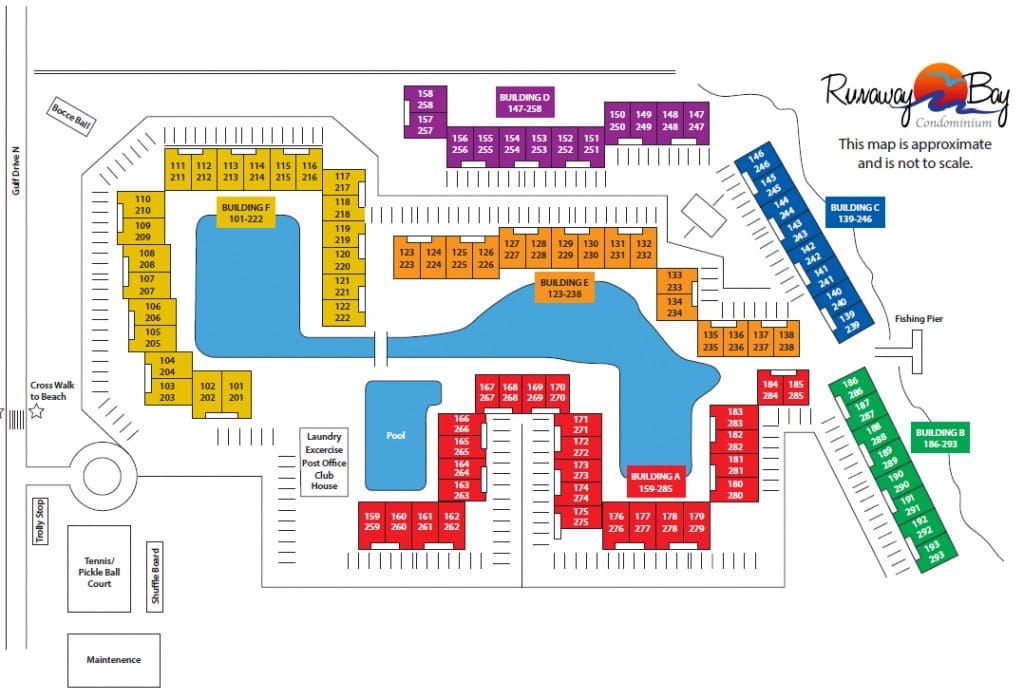

“American Coastal told us their sister company, AmRisc, was going to probably give us a proposal to insure us. We found out later on they were not. Over the next couple months, Mike scoured all the possible standard carriers. Nobody was willing to insure us in a reasonable and affordable manner. Most of them did not want to insure us because we are located on a barrier island, we’re framed construction, we’re two stories on ground level and we were built in 1978. We’ve got five condominium buildings, an operations building and a clubhouse,” Witzmann said.

“In September we were creeping up on our October first deadline to renew and Mike hadn’t gotten anybody so he had to go into the excess market which is made up of more high-risk carriers that usually only assume part of the risk. Our property policy was picked up by seven carriers that all split the risk. It’s called a layered program. It was the only thing we could do and the price was 337% higher than last year’s policy with American Coastal,” Witzmann lamented.

Witzmann was surprised that Citizens Property Insurance Corporation – the state-affiliated insurer of last resort – would not provide Runaway Bay’s property insurance.

According to the Citizens website, “Citizens was created by the Florida Legislature in August 2002 as a not-for-profit, tax-exempt, government entity to provide property insurance to eligible Florida property owners unable to find insurance coverage in the private market.”

“That’s why Citizens was created,” Witzmann said. “They’re supposed to insure places like us. We’re not some little operation. We have 186 units here. Mike went to them and they refused to insure us. I can understand for-profit carriers refusing to insure us given the market conditions right now, but Citizens was created to protect Florida citizens and they’re not doing that in our case. They turned us down when we were grasping at straws and needed their help. Citizens did not do their appointed duty,” he said.

“We had to get this layered insurance program that costs nearly $600,000 a year. Our assessments have gone up proportionately to cover that and our operations budget for the year went up about 40% because of the insurance. We have some owners who live here who are in their 70s and 80s, living on fixed incomes and well into their retirement funds. This is an increase in their monthly expenses that they did not anticipate and some of them are not going to be able to manage this. Most people who own units here at Runaway Bay rent them out to some extent. There are probably less than 20 people living here permanently, but that doesn’t change the reality for that small group of people. There are all kinds of economic concerns now,” Witzmann said.

“We set up an emergency task force of owners to look into this and figure out what our options are; and to hopefully bring these costs back in line somehow. We’re going to talk to our local and state legislators. We’ve got to bring everything we can possibly bear on this basic unfairness. We knew we’d have to pay more, but this increase is just ridiculous,” Witzmann said.

Insurance agent’s perspective

Mike Angers is Vice President of the Brown & Brown Sarasota insurance firm. As an agent, he focuses solely on condominium insurance.

“I’ve been doing condos for about 26 years. During the last six months, the insurance market’s taken a horrific turn. There are less carriers writing policies and the ones that are writing policies are tightening their underwriting guidelines and increasing their premiums. One of the main factors in the recent increases, non-renewals and policy cancellations is the roofs. If they haven’t been replaced or updated in the past 15-20 years, the carriers are getting off the account, increasing the premium to an almost unbelievable amount or putting in a restriction called actual cash value which factors in depreciation as well. All those components are not good for the client,” Angers said.

“The driver of this is that a lot of insurance carriers are involved in lawsuits that came down from Hurricane Irma in 2017. Unfortunately, there were some bad roofers and some bad insurance agents that were pushing fraudulent roof claims so there’s a ton of insurance carriers being sued right now over roof claims. So, these carriers are being really touchy about roofs right now,” he explained.

“With Runaway Bay, there was a non-renewal with American Coastal and they were telling us one of their subsidiaries, AmRisc, was going to release a quote in its place. About two weeks prior to the Oct. 1 renewal date they backed out. Brown & Brown is the largest writer of condo policies in the state so we have access to all the carriers. We sent it out to every single carrier in the state. We also tried Citizens and they declined it three times. We didn’t even have the option to go into that avenue of last resort. It was very painful. We ended up with a layered program where seven different carriers take a portion of the coverage,” Angers said.

Angers expects other Anna Maria Island condo associations and resorts with old roofs to experience similar insurance increases.

“There’s going to be a lot of horror stories, especially out on the islands. It’s a hit in the gut and it’s tough to deliver that news. I have to deliver a 100% increase tomorrow and a lot of my agent friends are seeing the same thing. The majority of the condo associations renew in the first and second quarter, so they haven’t felt it yet, but they will. It’s getting worse every day. Things may settle by the first or second quarter of 2022, but I don’t see the rates going down for a while. If you have a newer roof that’s within 15 years old you may be lucky and see an increase in the 20-25% range, but if that roof’s old it’s going to be painful,” Angers said.

“I had a condo association in Lakewood Ranch that ran into the same problem. I had it with some Siesta Key properties too. Most of these are going to be waterfront properties. If there’s not many other carriers competing for these policies, they can charge whatever they want. Limited carriers provide limited competition, which in turn creates a tough environment for the clients.”

Uncertain future

“I think you’re going to see a lot more Runaway Bays. There’s a lot of buildings on the Island that were built in the 60s and 70s. Six months ago, if you had a roof that was 15-20 years old and wasn’t leaking – or if you put the coating on it – that was OK. But now the carriers aren’t accepting that. Even Citizens is saying they don’t want it. Excess and surplus insurers are now the insurers of last resort,” Angers said.

“I think the state legislature will have to bend Citizens a little bit because they’re going to have to change the underwriting guidelines. As the market gets worse, you’re going to have more stories like this. We’re going to need to get some policies from Citizens. Citizens was the avenue of last resort. They would take someone no one else would take.

“Unfortunately, Citizens now has guidelines in place and roofs are a big issue for them too. To date, I’ve had four condo association clients that were declined by Citizens because of their roofs. If Citizens and the standard carriers are declining, you’re left with the excess and surplus carriers that offer the layered programs. They know you’re being declined so they really hit you hard, which is what happened with Runaway Bay.

“If you don’t have new roofs, you will pay the price. If you have a roof coating with a 10-year warranty it doesn’t matter because the carriers don’t accept that now. You have to put a whole new roof on,” Angers said, noting that getting new roofs installed may also prove challenging.

“These big associations have to get all the funds together. Then they have to get all the materials and a roofer to do it, and the roofers are as busy as can be right now. It used to be that if you started a roof project and had a contract signed that would be acceptable. Now the carriers want that completed before they’ll accept it. It’s bad news all the way around.”

According to Angers, state law prohibits condominium associations from self-insuring their buildings.

“Unfortunately, they can’t self-insure. Florida Statute requires the association to insure to 100% replacement cost, per the most recent appraisal. A homeowner that owns their home without a mortgage can do that, but a condominium association has to have full replacement cost coverage,” he said.

Additional impacts

Angers said resorts, apartment buildings and single-family homes are also susceptible to significant property insurance increases.

“A lot of these companies that write policies for condominium associations also write policies for resorts and apartment buildings. It’s the same carriers, so they’re going to have the same guidelines and increases. There are some different players in residential insurance, but they also have the same guidelines and it’s the same thing with the roofs because they got brought into lawsuits as well. It’s going to hit residential homes too and roofs are the big concern. They won’t take a recoating because that’s not considered a new roof. You have to have a new roof within the past 15-20 years or the carriers are going to pass on it – and the ones that do take it are going to charge a really high premium.

“I had a neighbor who just got a non-renewal notice because he didn’t put a new roof on. He ended up putting a new roof on and his premium still doubled. If he didn’t have a new roof, he wouldn’t have any coverage,” Angers said.